Accounting software for businesses is a game-changer in the realm of financial management, revolutionizing how organizations handle their finances. With features that streamline bookkeeping and reporting, these tools not only enhance accuracy but also drive operational efficiency. As businesses evolve, so do their accounting needs, and understanding the landscape of available software is crucial for making informed decisions.

Over the years, accounting software has transitioned from basic ledger systems to sophisticated platforms that integrate with various business tools. The current landscape offers diverse options, including cloud-based and on-premise solutions tailored to specific industries, ensuring that every business can find the right fit to enhance productivity and financial insight.

Overview of Accounting Software for Businesses

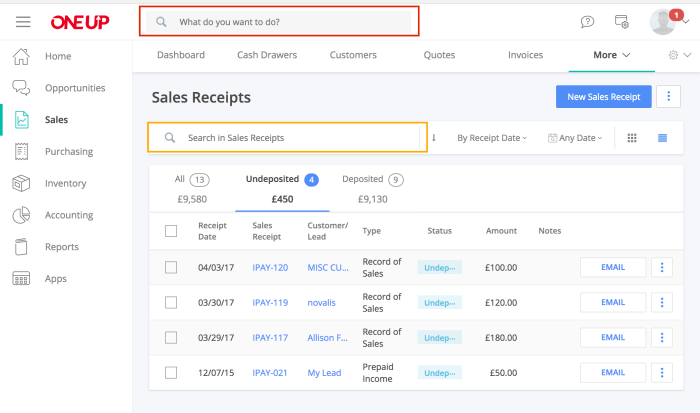

Accounting software plays a crucial role in the modern business environment by automating financial tasks that were once time-intensive and prone to human error. This software simplifies the management of financial transactions, allowing businesses to focus on growth and strategy instead of paperwork.

The primary functions of accounting software include tracking income and expenses, generating financial reports, managing payroll, and facilitating tax compliance. By providing real-time insights into financial performance, accounting software enhances business efficiency and accuracy. Over the years, the evolution of accounting software has seen a shift from traditional manual bookkeeping to sophisticated cloud-based solutions that offer scalability and integration with other business applications.

Types of Accounting Software

There are various types of accounting software available to meet the diverse needs of businesses. These include:

- Cloud-Based Accounting Software: This type is hosted on remote servers and accessed via the internet, enabling users to access their financial data from anywhere. Examples include QuickBooks Online and Xero.

- On-Premise Accounting Software: Installed locally on a company’s servers, this software requires a significant upfront investment and maintenance over time. Examples include Sage 50 and Microsoft Dynamics GP.

- Industry-Specific Accounting Software: Tailored for specific sectors such as retail or manufacturing, this software addresses unique industry requirements. For instance, Fishbowl is designed for manufacturing, while Vend serves the retail sector.

Comparing cloud-based and on-premise solutions reveals distinct advantages. Cloud-based software typically offers lower initial costs and easy updates, while on-premise software can provide enhanced control over data security and customization options.

Key Features to Look for in Accounting Software

When selecting accounting software, businesses should focus on essential features that enhance productivity and user experience. Important features include:

- Automation of Routine Tasks: The software should automate processes like invoicing and reconciliations to save time.

- User-Friendly Interface: A clear and intuitive interface is vital for ease of use, ensuring that employees can navigate the software without extensive training.

- Integration Capabilities: The ability to integrate with other business tools, such as CRM systems and e-commerce platforms, is crucial for streamlined operations.

The significance of these features lies in their potential to simplify daily operations and improve overall business efficiency.

Benefits of Using Accounting Software

Utilizing accounting software offers numerous advantages, including:

- Automation of Bookkeeping Tasks: This reduces the need for manual entries, decreasing the likelihood of errors.

- Improved Financial Reporting: Accurate and timely financial reports support better decision-making processes.

- Cost Savings: By streamlining financial operations, businesses can reduce labor costs associated with manual accounting practices.

These benefits contribute significantly to a business’s financial health and operational efficiency.

Challenges in Implementing Accounting Software

While accounting software provides many advantages, businesses often encounter challenges during implementation. Common obstacles include:

- Resistance to Change: Employees may be hesitant to adopt new software due to familiarity with existing processes.

- Data Migration Issues: Transitioning data from old systems to new software can be complex and time-consuming.

- Training Requirements: Staff may require extensive training to effectively utilize the new software.

To overcome these challenges, businesses can focus on effective change management strategies, including providing adequate training and support.

Selection Process for Accounting Software, Accounting software for businesses

When evaluating accounting software options, businesses should follow a structured selection process. A checklist for businesses includes:

- Define specific needs and requirements.

- Research and compare different software solutions.

- Conduct software demonstrations with potential vendors.

- Assess vendor support and training options.

Following these steps ensures that businesses choose the right software that aligns with their operational goals and user needs.

Future Trends in Accounting Software

As technology advances, accounting software is evolving rapidly, influenced by emerging trends such as:

- Artificial Intelligence and Machine Learning: These technologies are enhancing automation capabilities, allowing for smarter data analysis and predictive insights.

- Cybersecurity Enhancements: With increased reliance on digital solutions, robust cybersecurity measures are becoming critical for protecting sensitive financial data.

- Mobile Access: The growing trend of mobile accounting applications allows users to manage finances on-the-go, further enhancing flexibility and responsiveness.

These trends are shaping the future landscape of accounting services, making them more accessible and efficient.

Case Studies of Successful Accounting Software Implementations

Numerous businesses have successfully integrated accounting software into their operations, leading to significant improvements. For example:

- A retail company reported a 30% reduction in time spent on bookkeeping after implementing a cloud-based solution, leading to increased staff productivity.

- A manufacturing firm saw its financial reporting turnaround time decrease from days to hours, allowing for quicker decision-making.

- A service-based business achieved a 25% increase in profitability post-implementation through better expense tracking and management.

These case studies highlight the measurable impact of accounting software on efficiency and profitability, showcasing key lessons learned throughout the integration process.

End of Discussion

In conclusion, selecting the right accounting software can significantly impact a business’s efficiency and financial health. By automating tasks, improving reporting, and offering insights for better decision-making, these tools provide a competitive edge. As technology continues to advance, staying informed about new features and emerging trends will empower businesses to adapt and thrive in an ever-changing financial landscape.